Read what we think.

Our experienced team share

their views!

Review Summary

Today BritFX is diving into an FXCM forex broker review! Established in 1999, they have over 20 years of history behind them, and are regulated by the FCA and ASIC. FXCM’s key selling point is zero commissions. Whilst that sounds good on paper, I have broken down how this pricing really works in our FxPro review will be breaking that down to see how it works later in the review. I will be explaining it further in this review as well, and outlining the true cost of trading with FXCM.

As a powerhouse broker that’s been operating for 20+ years FXCM offers some neat functions and innovative features, so keep reading our full review to learn more!

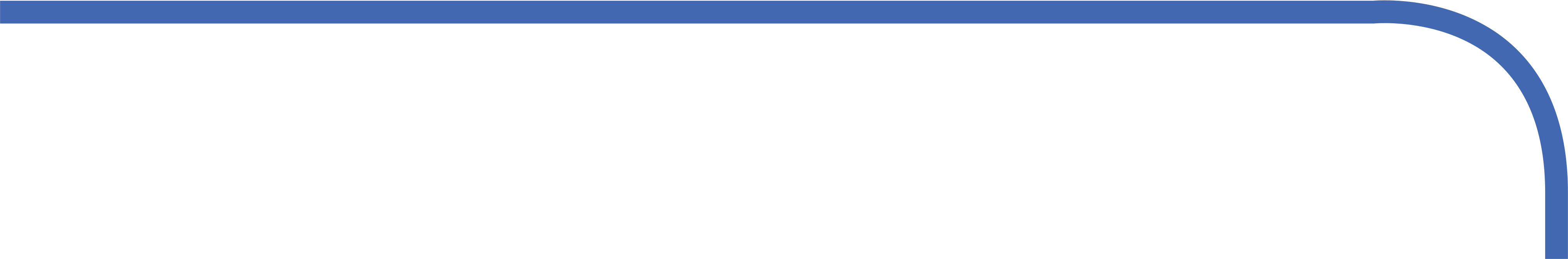

Opening a new account

Opening an account with FXCM is seamless; their same day verification process allows clients to get trading within 24 hours. I was verified with them within 3 hours at most. They only offer leverage up to 30:1, which is the maximum leverage available under the FCA.. They offer no minimum deposit, which is great as it allows forex traders to get started with however small or large an account as they see fit. So far so good, opening a forex trading account with FXCM was a smooth process!

FXCM offers 30:1 leverage, easy and fast account opening and verification, and no minimum deposit.

The Facts

| Open new Account | Fast & Easy |

| Minimum Deposit | $50 |

| Leverage | 30:1 |

| Deposit & Withdrawals | Easy with a few choices |

| Customer Support | 24/5, good quality |

| Education | Great quality and educational offerings |

| Research | News, technical and fundamental analysis |

| Speed of Execution | Average, frequent slippage |

| Product Portfolio | Limited Portfolio |

| Commissions | Spread Based |

| Spreads | High |

| Hidden Fees | No hidden fees |

| Our Rating |

Broker Review

FXCM has Industry standard 24/5 support, so of course we put this to the test! The first aspect of the live chat I noticed is that you have to fill out a sizable questionnaire just to open a live chat; I was unimpressed by this as in my opinion live chats should be a click and question, with as minimal information requested about you as possible. Once on the chat, the live chat took over an hour to get back to me, which is quite slow, so I was disappointed again. They do offer their email, phone numbers and even a SMS support service, which I haven’t seen anywhere else, so props there.Due to their slow customer support and questionnaire to access live chat I’ve docked them a point here.

Being a powerhouse forex broker, FXCM offers high quality educational content and market analysis. They cover Forex basics, traits of successful traders and run webinars every day on DAX, London and US open. They also feature a Cryptocurrency webinar every Wednesday. Their webinars are of reasonable quality and a great touch by FXCM in supporting their clients trading journeys. FXCM has a markey analysis area on their website, keeping traders updated with both fundamental and technical news and opportunities.

They also provide a set of MT4 trading tools as brokers usually do. Something quite appealing with FXCM is that they integrate their price feed with the Tradingview charting software and enable traders to trade entirely from Tradingview. They also give clients access for 1 year to the Tradingview Pro Plan for free. I love this feature about FXCM as tradingview is the most popular charting platform, so it’s quite an incentive to open an account with FXCM.

Their range of tradable products is very small, limited to 39 currency pairs and a few indexes, indices, cryptocurrencies and commodities. This could certainly be improved as it is not competitive at all with the industry. I docked FXCM a point based upon their limited product portfolio.

FXCM boasts low slippage rates, with 70% of their orders not receiving slippage. They also state that 69% of the limit orders that experience slippage have positive slippage. Trading with them I didn’t experience slippage, but due to their spread pricing options it’s difficult to accurately place limit/stop orders. Order execution wasn’t an issue for me while trading with them and they boast an average of 0.02 seconds (20 milliseconds) order fill, which is quite competitive considering IC Markets averages under 40 milliseconds for execution.

FXCM is a forex broker with some innovative products and quality trade execution, however I’ve docked two points in this section due to limited product portfolio and certain aspects of their 24/5 support.

Spreads, Commissions and Fees

FXCM has a spread based commission, meaning that they make money from the spread rather than charging a set amount of commission. This benefits them as they can advertise “no commissions”. So how does the spread compare to other “no commission” brokers? FXCM states that their average EURUSD spread is 1.2 pips. A movement of 1.2 pips on 1 standard lot (1.00) is worth $12, which traders pay on opening and closing a position. That means that to trade 1 lot round trip traders pay $24, far more than IC Markets or Pepperstones commission of $7 per lot/round trip. BritFX has also reviewed FxPro, another spread-based commission broker that had an average EURUSD spread of 1.518223 during August 2020 (verified by TradeProofer). In comparison to this, FXCM has the better pricing model.

Trading with FXCM is extremely expensive compared to brokers with commissions, and are docked both their commission and spread points here. Their pricing is well outside of what is considered competitive in the forex broker industry. On the plus side FXCM do not charge any hidden fees, so they receive one point there.

FXCM boast “no commissions”, but their wide spreads make trading extremely expensive, and not a viable option for serious traders, scalpers or expert advisors.

My Experience

Overall FXCM is a forex broker with some really cool features, and I love the integration with Tradingview. They offer quality educational resources and trader support, however, simply put their pricing is just not good enough.