Read what we think.

Our experienced team share

their views!

Review Summary

Hi traders, and welcome back to BritFX! This time our team are taking on the powerhouse IC Markets! IC Markets is one of the most notorious Forex Brokers, known for their razor sharp spreads and top trading conditions. As usual, I will be challenging this reputation and finding out if it is deserved, as well as challenging their key marketing points!

So first, a bit about IC Markets. They are an Australian Forex broker, established in 2007. We found their ASF Licence was issued in 2009, so they they have established a track record over 10 years. IC Markets are also recognised and regulated by the FSA (Seychelles) and CySec (Cyprus). Their website’s key advertised points are spreads as low as 0.0, “ultra fast order execution”, 220+ tradable instruments and 24/7 support.

IC Markets has a great reputation, so let’s see how they really stack up!

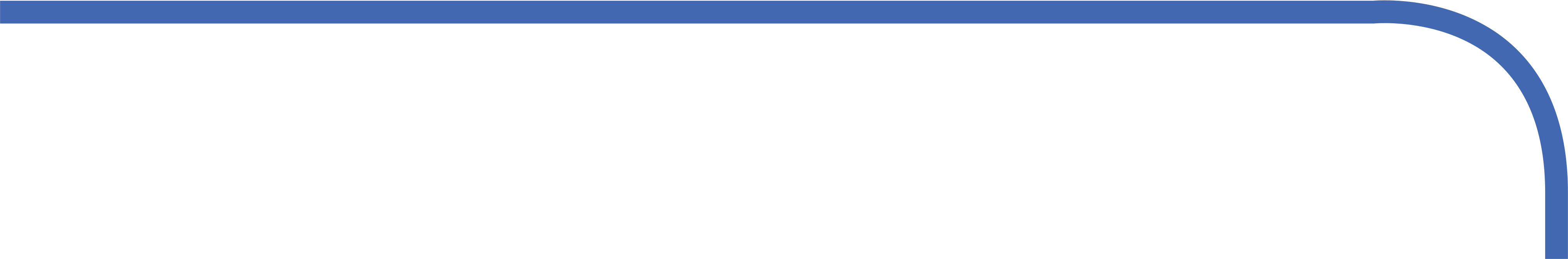

Opening a new account

Opening an account with IC Markets is very quick and easy, and offers both the MetaTrader and Ctrader platforms, my personal favourite being Ctrader. It’s great that IC Markets offer both platform systems, as many Forex Brokers only offer MT4 & MT5.

Default leverage for any account is 400:1, however traders can adjust this when opening an account, with available leverage of up to 500:1. BING, IC Markets first point right there! I was verified in less than 2 hours, and given access to trading very quickly; the first interaction I had of their customer service, giving me a positive impression. Whilst IC Markets have no deposit necessary to open an account, they do have a minimum deposit size of $200! Come on IC! There are numerous brokers out there with no minimum size, so IC Markets isn’t extremely competitive there.

Opening an account with IC Markets is seamless, and they offer great leverage which is often the lifeblood of a retail FX trader. Having a minimum deposit size is not competitive in today’s broker environment, so IC Markets loses a point there.

The Facts

| Open a new account | Fast & Easy |

| Minimum deposit | $200 |

| Leverage | 500:1 |

| Deposit & Withdrawals | Quick with many methods |

| Customer Support | 24/7, great quality |

| Education | Great quality and educational offerings |

| Research | News, technical and fundamental analysis |

| Speed of execution | IC Markets has great execution, < 40ms |

| Product portfolio | Extensive, 232 instruments, 7 asset classes |

| Commissions | $3.5 |

| Spreads | 0.0 Verified |

| Hidden Fees | No hidden fees |

| Our Rating |

Broker Review

So what is it that IC Markets offer its clients? The first feature IC Markets boast is their 24/7 support; an industry leading offer. Typically brokers offer 24/5 support, so nonstop support is quite a neat feature that gives IC a competitive edge. You can also arrange a callback to talk with a customer agent at a time that suits you, even on weekends! Obviously these are quite strong marketing points, so I put their customer support to the test… Are they knowledgeable and do they respond quickly?

I messaged IC Markets live chat at 10:15am on a Tuesday and they replied and they replied over an hour later at 11:50am, quite slow for a live chat although they did notify me it was a high traffic event, with over 20 people in the line ahead of me. Once I was in contact with an agent they were extremely informative and rather than giving canned responses or directing to a webpage they made sure to answer any queries I had. Since this first encounter with their support I’ve contacted their customer support a number of times and never waited more than 5 minutes. Overall a very nice personal touch with professional staff, the first indicator that IC Markets is the powerhouse forex broker that its reputation suggests.

In terms of resources, IC Markets has it all. IC Markets offer both Trading Central and chart recognition software Autochartist integration. Both are well known and respected technical analysis softwares, perfect for assisting every level of trader. In addition, IC Markets also have a range of educational free resources for traders of all levels. Unfortunately, IC Markets client portal isn’t that well designed, and finding all the resources at your disposal is a bit difficult and overwhelming.

The funding methods available vary significantly from each Forex broker, with some being very limited in terms of base currencies and funding platforms, and others having a plethora of options. There is no doubt that IC Markets falls into the later category, with over 16 different funding methods, and 10 base currencies to choose from. Popular funding methods include credit card, PayPal, Poli, bank transfer and many more. IC Markets really flexes its muscles here, another tell-tale sign of a powerhouse broker.

IC Markets offer their clients 232 tradable instruments, with CFD’s across Forex, Bonds, Equities, futures, commodities, indices and crypto currencies. Across all of these products IC Markets is renowned for one thing: trading conditions! This reputation is well deserved, with extremely low order latency achieved through their two servers in New York and London. One of their key boasting points is being the largest FX CFD provider in the world by volume, and have a maximum lot size of 200, so that high volume traders can really go in swinging on an IC Markets account!

IC Markets impressive resources to support their clients trading execution, performance, account funding and education. With their offerings and high quality trade execution it gets me wondering… how much do traders pay for this?

Spreads, Commissions and Fees

After considering the non-trading resources offered by IC Markets, you would be forgiven for thinking that their trading costs are high, but in reality they are some of the best on the Market! First, let’s discuss their spreads.

IC Markets “Raw” spreads are as good as unbeatable, quite simply put. Through our partner, TradeProofer, we have verified IC Markets has spreads from 0.0, with 0.0 being tradable frequently on major pairs. On EURUSD they averaged a spread of 0.071257 for the entire month of August 2020, a spread below a tenth of a pip!

The next notable trading cost is commissions. IC Markets commission isn’t exactly low, but it is market competitive with a round trip of $7 per lot ($3.5 a side). In my opinion, this is merely the cost of playing with the big boys. IC Markets offers institutional grade quality, and are certainly far more affordable than a Bloomberg terminal, so in my books they’re doing well! IC Markets have no outstanding or hidden fees; the only costs are trading related. They do not take a commission on deposits, however certain methods such as Paypal charge a fee.

IC Markets spreads and commissions are ultra-competitive, again establishing dominance in the Forex Broker space.

My Experience

My experience trading Forex with IC Markets is that they are a serious forex broker, for serious forex traders. In an industry that is constantly evolving and ever-competitive, IC Markets manages to stay at the forefront, an impressive feat.